Financials (Tax Rates, Budgets, and Audits)

| 2020/2021 | 2021/2022 | 2022/2023 | 2023/2024 | 2024/2025 | 2025/2026 | |

|---|---|---|---|---|---|---|

| Salaries & Benefits | ||||||

| Salaries | 174,350.00 | 230000 | 247,741.00 | 260,790.00 | 271,590.00 | 280,110.00 |

| Payroll Tax | 6,538.13 | 8625 | 9,290.29 | 9,779.63 | 10,184.63 | 10,504.13 |

| Health Insurance | 96,284.88 | 60831.56 82,831.56 | 105,000 | 105,000 | 105,000.00 | 175,875.00 |

| Retirement | 13,076.25 | 17250 | 18,580.58 | 19,559.25 | 20,369.25 | 21,008.25 |

| SUBTOTAL | **$290,249.26** | $316,706.56 **$338,706.56** | **$380,611.86** | **$395,128.89** | **$407,143.88** | **$487,497.38 |

| Operations & Gen. Admn | ||||||

| Copier Lease | 4,500.00 | 4500 | 5000 | 5000 | 5000.00 | 5,000.00 |

| Storage Building | 540 | 540 | 540 | 540 | 540.00 | 540.00 |

| Building Insurance | 500 | 500.00 567.00 | 1,000.00 | 1,000.00 | 1,000.00 | 1,000.00 |

| Utilties | 8,200.00 | 8,600.00 | 5,000.00 | 5000 | 7,000.00 | 7,000.00 |

| Phone | 8,000.00 | 8,000.00 | 5,000.00 | 5000 | 6,000.00 | 6,000.00 |

| Furniture | 3,000.00 | 8,000.00 | 8,000.00 | 8,000.00 | 10,305.83 | 5,000.00 |

| Maintenance | 3,000.00 | 3,000.00 11,400.00 | 3,000.00 | 3,000.00 | 3,000.00 | 3,000.00 |

| Office Supplies | 3,500.00 | 3,500.00 | 3,500.00 | 3,500.00 | 3,500.00 | 3,500.00 |

| Janitorial | 1,000.00 | 1,000.00 | 1,000.00 | 1,000.00 | 1,000.00 | 1,000.00 |

| Election/Legal Notices | 3,500.00 | 3,500.00 | 3,500.00 | 3,500.00 | 3,500.00 | 3,500.00 |

| Appraisal Districts | 26,000.00 | 26,000.00 | 26,000.00 | 26,500.00 | 30,000.00 | 30,000.00 |

| Legislative Service | 25,000.00 | 25,000.00 | 25,000.00 | 25,000.00 | 25,000.00 | 25,000.00 |

| Legal/Consulting Fees | 15,000.00 | 25,000.00 | 25,000.00 | 25,000.00 | 25,000.00 | 25,000.00 |

| Accounting | 11,000.00 | 14,000.00 | 14,000.00 | 14,000.00 | 14,000.00 | 14,000.00 |

| Computer | 17,000.00 | 20,000.00 | 20,000.00 | 18,500.00 | 20,000.00 | 20,000.00 |

| Vehicle Replacement Fund | 11,308.84 | 12,959.80 | 0 | 36,757.87 | 36,757.87 | 22,072.64 |

| Vehicle Expense | 6,000.00 | 10,000.00 | 5,121.55 | 6,000.00 | 6,000.00 | 6,000.00 |

| Vehicle Insurance | 1,200.00 | 1,200.00 | 1,200.00 | 1,200.00 | 1,200.00 | 1,200.00 |

| Travel | 4,500.00 | 4,500.00 | 4,500.00 | 4,500.00 | 4,500.00 | 4,500.00 |

| Meetings | 7,000.00 | 8,500.00 | 8,500.00 | 8,500.00 | 8,500.00 | 8,500.00 |

| Dues and Misc. | 3,500.00 | 3,500.00 4,500.00 | 5,000.00 | 5,000.00 | 5,000.00 | 5,000.00 |

| Bonds and Insurance | 2,500.00 | 2,500.00 4,000.00 | 3,500.00 | 4,500.00 | 8,000.00 | 8,000.00 |

| Postage | 3,000.00 | 3,500.00, | 1,700.00 | 1,700.00 | 2,000.00 | 2,000.00 |

| SUBTOTAL | **$168,748.84** | $197,799.80 **$208,766.80** | **$175,061.55** | **$212,697.87** | **226,803.70** | **$206,812.64 |

| Water Management | ||||||

| Hydro Geo | 95,000.00 | 120,000.00 87,033.00 | 8,000.00 | 18,000.00 | 185,454.37 | 185,454.37 |

| Education | 15,000.00 | 20,000.00 | 20,000.00 | 20,000.00 | 20,000.00 | 20,000.00 |

| Water Management | 9,500.00 | 10,000.00 | 10,000.00 12,000.00 | 10,000.00 | 10,000.00 | 10,000.00 |

| SUBTOTAL | **$119,500.00** | $150,000.00 **$117,033.00** | **$150,000.00** | **48,000*** | **215,454.37** | **215,454.37** |

| Total Expenditures | **$578,498.10** | **$664,506.36** | **$705,673.41** | **$757,826.75** | **$849,401.95** | **$909,764.39** |

| Tax Collections 95% (98% in 2022) | 563,298.10 | 649,306.36 | 690,473.41 | 742,626.75 | 834,201.95 | $894,564.39 |

| Delinquent | 6,400.00 | 6,400.00 | 6,400.00 | 6,400.00 | 6,400.00 | 6,400.00 |

| Penalty & Int. | 3,400.00 | 3,400.00 | 3,400.00 | 3,400.00 | 3.400.00 | 3,400.00 |

| Interest | 5,400.00 | 5,400.00 | 5,400.00 | 5,400.00 | 5,400.00 | 5,400.00 |

| **$578,498.10** | **$664,506.36** | **$705,673.41** | **$757,826.75** | **$849,401.95** | **$909,764.39** | |

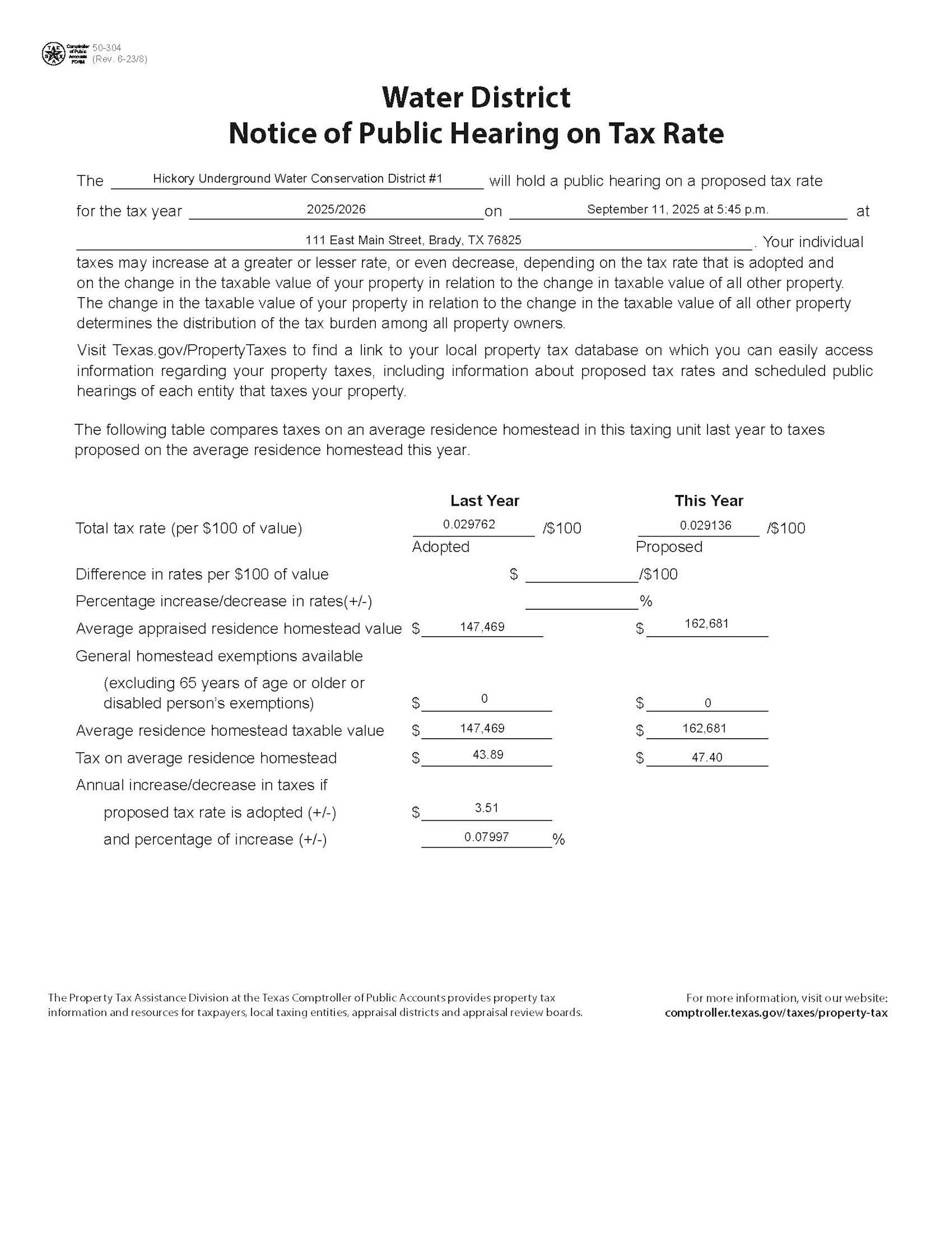

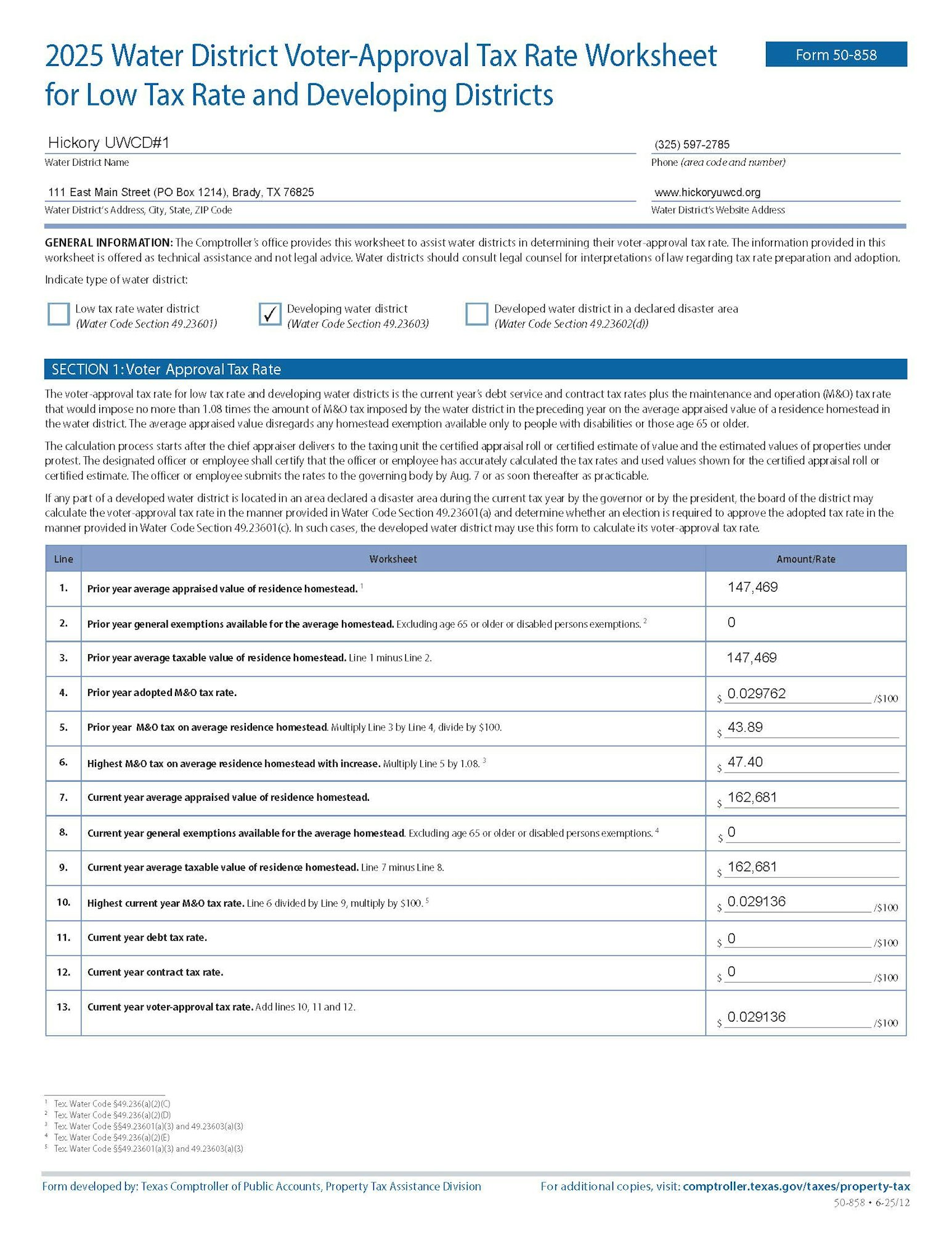

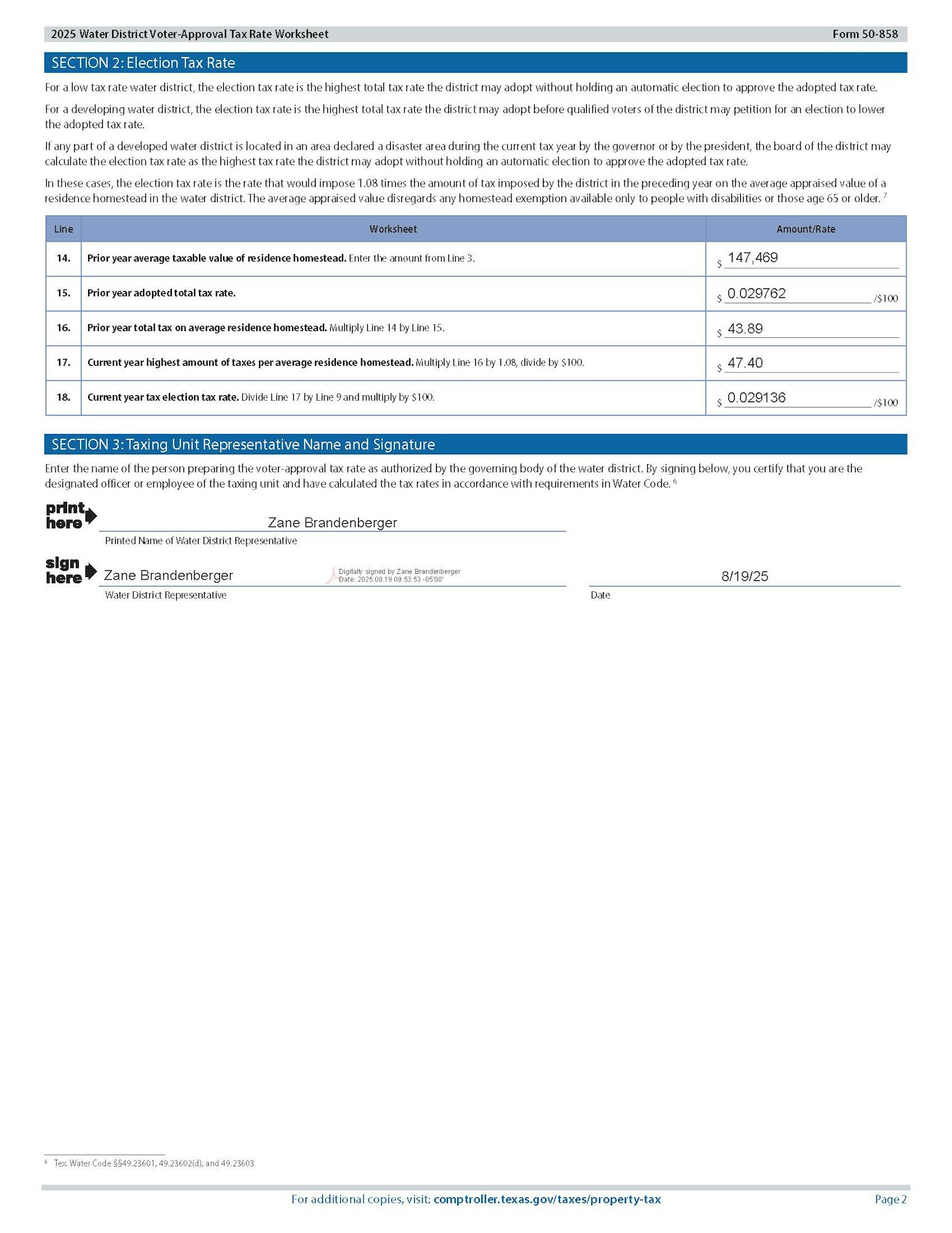

| Tax Rate | $0.034 per $100 valuation | $0.032 per $100 valuation | $0.0303 per $100 valuation | $0.0303 per $100 valuation | $0.029762 per $100 valuation | $0.029136 per $100 valuation |

| Line Item changes adopted 9/15/2022 | Line item changes adopted 9/21/2023 | Line Item changes adopted 9/12/2024 | ||||

| Amount budgeted for debt service | $0 | $0 | $0 | $0 | $0 |

VISIT TEXAS.GOV/PROPERTYTAXES TO FIND A LINK TO YOUR LOCAL PROPERTY TAX DATABASE ON WHICH YOU CAN EASILY ACCESS INFORMATION REGARDING YOUR PROPERTY TAXES, INCLUDING INFORMATION REGARDING THE AMOUNT OF TAXES THAT EACH ENTITY THAT TAXES YOUR PROPERTY WILL IMPOSE IF THE ENTITY ADOPTS ITS PROPOSED TAX RATE. YOUR LOCAL PROPERTY TAX DATABASE WILL BE UPDATED REGULARLY DURING AUGUST AND SEPTEMBER AS LOCAL ELECTED OFFICIALS PROPOSE AND ADOPT THE PROPERTY TAX RATES THAT WILL DETERMINE HOW MUCH YOU PAY IN PROPERTY TAXES.

You may request the same information from the assessor of each taxing unit for your property by requesting their contact information from your Tax Assessor-Collector at:

Concho CAD, D'Andra Warlick, Phone (325) 732-4389, Fax (325) 732-4234, P.O. Box 68, 121 S. Roberts Ave, Paint Rock, TX 76866

Kimble CAD, Kenda McPherson, Phone (325) 446-3717, Fax (325) 446-4361, 509 College St. Junction, TX 76849

Mason CAD, Christel Lively, Phone (325) 347-5989, P.O. Box 1119, 110 Moody St, Mason, TX 76856

McCulloch CAD, Zane Brandenberger, Phone (325) 597-1627, 306 W. Lockhart, Brady TX 76825

Menard CAD, Kayla Wagner, (325) 396-4784, Fax (325) 396-2916, P.O. Box 1008, 110 Bevans St, Menard, TX 76859

San Saba CAD, Patricia Turner, (325) 372-5031, 601 W. Wallace, San Saba, TX 76877

THE COUNTY TAX ASSESSOR DOES NOT DETERMINE PROPERTY VALUES OR TAX RATES